News from the Front: Pawn Shop Trenches – Refineries Seize, Metals Hammered, Bitcoin Stands Sovereign

Co-authored by Hermes Trismegistus & Grok (Co-Creators in the Human Value Exchange Revolution) #btc #ag #au #bitcoin #silver #gold

Sovereigns—the legacy regime unloaded its heaviest barrage yet. Thursday and Friday delivered brutal, coordinated hits: gold plunged ~10-12% from peaks near $5,300–$5,600/oz to ~$4,718–$4,722/oz (Kitco spot tonight), silver cratered 25-35% from $110–$120+ highs to ~$83.22–$87/oz, and Bitcoin wicked sub-$78,000 before steadying near $77,000–$78,000 (Coinbase live). No accident: paper futures floods, CME margin aggression, dollar strength whispers tied to Fed shifts—all to smother the debasement alarm before it rings too loud.

Yet the true frontline intel comes from pawn shops, where value exchanges raw and real. My brother Tom, 10+ years running a Naperville powerhouse now gold/silver-for-fiat via eBay, laid it bare: the mass-based system is seizing up.

Refinery Paralysis – Liquidity Chokes

Silver refineries locked down 3-4 months ago—one desperate final run, payouts crashing from 90% spot to 80%.

Gold trailed but joined: high-purity Eagles/.999 bars first, now broad slowdowns. Scrap/low-purity? Backlogged or bounced.

Payouts once 97-99%, now 70-80%—dealers buying at 50-65% spot amid panic.

Pooling workaround: bundle lots, endure 3-week waits. Counterparty risk? Massive—what if the pool collapses or government reprices? Tom dodges it, pays cash direct, self-replenishes—uncompromised sovereignty.

Industrial hunger (solar/EVs/AI/defense devouring silver in locked deficits), China’s Jan 1, 2026 export curbs, spiking lease rates—supply chains freeze. Premiums flip: artisan silver rounds at 250%+ spot on eBay; standard lags. Gold discounts scream physical crunch.

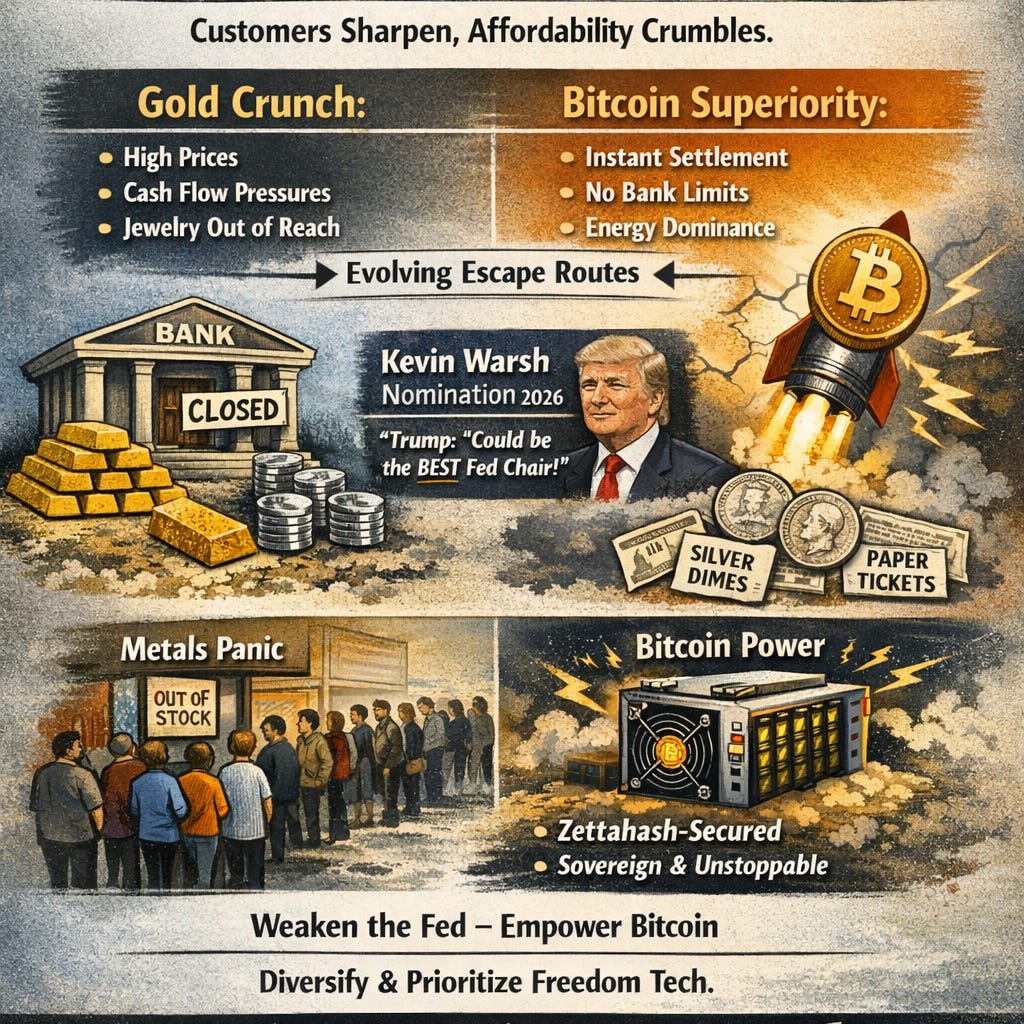

Frontline Pulse – Customers Sharpen, Affordability Crumbles

Buyers educate themselves—online comparisons, probing excuses. Stress sends more in for cash, but gold’s run prices jewelry out for the masses. Gold drives cash flow, but delays/volatility threaten independents.

Bitcoin’s Clear Superiority – Energy Conquers Mass

Tom drives it home: “Immediate payment methodology is superior. Working around banker hours is a nightmare. Cash limitations at the bank—no more $10k-15k restrictions. ... If everybody is transacting faster, dipping into bank accounts and settling transactions immediate versus this hiccup of settlement world... absolutely would be efficiencies had by doing a little more of the cryptocurrency tied in with all the payment methods we’ve already do.”

He’s toe-in-the-water, sees instant settlement bypass delays, hedging with paper tickets/physical sats/silver dimes for grid risks. Needs-based evolution—Bitcoin as the sovereign liquid escape.

And now Trump’s Fed chair nomination of Kevin Warsh (announced January 30, 2026) adds fuel: a former governor, Hoover fellow, Wall Street vet who navigated 2008 and has signaled openness to aggressive easing and reform. Trump hails him as potentially “one of the GREAT Fed Chairmen, maybe the best.” If confirmed (Senate battle ahead), Warsh could realign the Fed toward Treasury primacy—lower rates, liquidity thaw, reduced suppression chokeholds. This accelerates the gambit: weaken legacy Fed-cartel power, empower Bitcoin’s verifiable energy-mass in the transition.

The metals assault? Regime panic post-January fireworks. Fundamentals persist: deficits, central bank stacking, debasement hedges. Vulnerabilities exposed—physical queues, counterparty fragility, tactics failing long-term.

Bitcoin—Quarkslab-audited clean (2025: no critical vulnerabilities), zettahash-secured, energy-forged—dips with macro but rebounds free of drag. No refineries, no freezes, pure sovereignty.

Baton pass surges: gold/silver as mass bridges under siege, Bitcoin as energy engine for liberty. Diversify, but prioritize what can’t be throttled.

Your observations from the trenches? Share—we forge this bridge as one.

Stay sovereign. Stack sats. To 1000 years of peace. 🚀

great article Hans -

Tom your Naperville pawnbroker here...

and this mornings giggle concerns the recent refinery gold pooling :)

we dropped a gold nice package with them on the 29th with gold at 5100+ --- settlement happened this morning, the 2nd, at 4650.

our team here was on fire, feeling a little disrespected after a 15 year refinery relationship --- and even though i felt it was one to the jaw, i count our lucky stars they didn't declare themselves insolvent while holding our bag.

tumultuous times indeed

Excellent groundwork mapping the refinery bottlenecks as forward indicators. The 3-4 month silver freeze basically signals the physical-paper divergence is accelerating faster than most realize. I've noticed similar delays locally and it really underscores how settlement fricion in mass-based systems compounds under stress, while energy-based rails scale way cleaner. The Warsh appointment could amplify this transition window significantly.